"Our company’s achievements to date have not been by accident."

Mineral Resources Limited

2024 Annual

Report

Building innovative projects. Developing talented people. Owning our difference.

Mineral Resources’ diverse business model and unique culture support world-class projects and deliver long-term benefits for employees, communities, and shareholders.

This year, one of the most significant milestones in our company’s history was achieved when Onslow Iron delivered first ore on ship – the culmination of ambition, innovation, and expertise developed over three decades.

This and many other achievements over the past 12 months have been driven by our people, who MinRes continues to support, develop, and empower to keep our company operating safely, efficiently, and productively.

Our 2024 Annual Report acknowledges one of the best development years in our company’s history and celebrates the next generation of our MinRes workforce – our apprentices and graduates – who apply fresh thinking, enthusiasm, and problem-solving skills to help write our next chapter.

At MinRes, the future’s bright. We keep innovating, challenging the status quo and setting new industry standards because we dig different.

Acknowledgement of Country

MinRes is committed to reconciliation and recognises and respects the significance of Aboriginal and Torres Strait Islander Peoples' communities, cultures and histories.

We acknowledge Aboriginal and Torres Strait Islander People as the first and continuing custodians of the land and waters and in doing so pay respect to Elders past and present.

Corporate

review

The most productive year yet for Mineral Resources saw our company deliver significant internal achievements and push through external challenges, which in many ways reflects the very nature of our long-term success.

Our track record for seizing opportunities and remaining agile to changing environments has guided MinRes’ growth into one of Australia’s leading resources developers and operators. FY24 delivered strong operational performance headlined by the launch of our transformational Onslow Iron project – which achieved first ore on ship ahead of schedule in May – supported by record mining services earnings and record lithium production from Wodgina and Mt Marion mines.

Challenging global commodity markets, particularly in lithium, impacted overall earnings. Combined with the significant capital investment in Onslow Iron, this environment reinforced the company’s ongoing focus on responsible balance sheet management while emphasising multiple liquidity options that remain available.

MinRes’ diverse business model provides structure and reliability to help weather economic headwinds. While net debt has increased, it is manageable and covenant light with tenor structured for the profile of future earnings. The Board and Executive are aligned on a near-term conservative approach and that MinRes’ world-class commodity assets and unique business model, including noncyclical services and infrastructure earnings, positions us to deliver ongoing returns for our shareholders and a longer-term focus on continued growth.

"The MinRes business model is structured to withstand external market challenges."

This has been one of the best development periods in our company’s history.

Headlined by the launch of our transformational Onslow Iron project, the past 12 months have demonstrated the essence of our MinRes culture – passion for innovation, can-do mindset, commitment to go above and beyond and an appreciation of the value in our people.

From a financial perspective, tough commodity markets impacted overall earnings. Revenue was up 10 per cent year-on-year to $5.3 billion but a dramatic downturn in the lithium price contributed to a 40 percent reduction in underlying EBITDA to $1.05 billion.

Despite commodity price challenges, our steady results highlight the strength of MinRes’ business model, with diverse income streams all contributing to solid group earnings and a pleasing production performance.

Record Mining Services earnings of $550 million were up 14 percent year-on-year, an outstanding outcome backed by a nine per cent increase in production volumes.

Our Iron Ore division increased shipments by three per cent and grew revenue by 20 percent, while our Lithium business delivered record production from Mt Marion and Wodgina.

Balance sheet management remains a key focus and while net debt has increased, it remains manageable. Once Onslow Iron becomes cash flow positive before end of this year and production volumes rise, cash inflows will increase significantly and support rapid deleveraging of the balance sheet.

Operational

Excellence

Onslow Iron first ore on

ship delivered

330 tonne road train fleet

expanded to 107

20,000 tonne transhippers

operational

Expanding engineering and

construction capability

Financial

review

"MinRes has significant value embedded across its operations."

FY24 was a milestone year for MinRes as it continued to invest in long-life assets such as Onslow Iron, which will deliver transformational growth for our company.

During the year, Chinese entities established new sources of lithium supply in Africa and China, resulting in a sharp reduction in global lithium prices. The average price realised by MinRes for its lithium sales dropped by more than 70 per cent compared to the previous year and this flowed directly through to MinRes’ profits.

Nevertheless, Underlying EBITDA remained solid at $1.1 billion, down 40 per cent on the prior year, while headline revenue of $5.3 billion was up 10 per cent on the prior year.

The company’s result was underpinned by encouraging operational and production performances across key business pillars, demonstrating the diversity and strength of MinRes’ business model.

Mining Services remains the heartbeat of MinRes and in FY24 delivered the Group’s standout financial performance, with record Underlying EBITDA of $550 million up 14 per cent on the prior year.

Earnings were driven by growth in external crushing and haulage volumes as we continue to strengthen MinRes’ reputation as one of the most innovative and reliable mining services providers in Australia.

Record production volumes from Mt Marion and Wodgina mines assisted in mitigating the impact of the decline in lithium prices, with the Lithium division delivering Underlying EBITDA of $384 million. While markets remain challenging, MinRes will focus on reducing costs and optimising product output in readiness for improved lithium prices.

Our Iron Ore division delivered on guidance across production volumes and costs. Revenue of $2.6 billion was up 20 per cent year on year, bolstered by improved achieved prices from lower product discounts and increased shipments.

MinRes has significant value embedded across its various operations and is constantly assessing opportunities to release this value where it makes sense to do so.

Operational Review

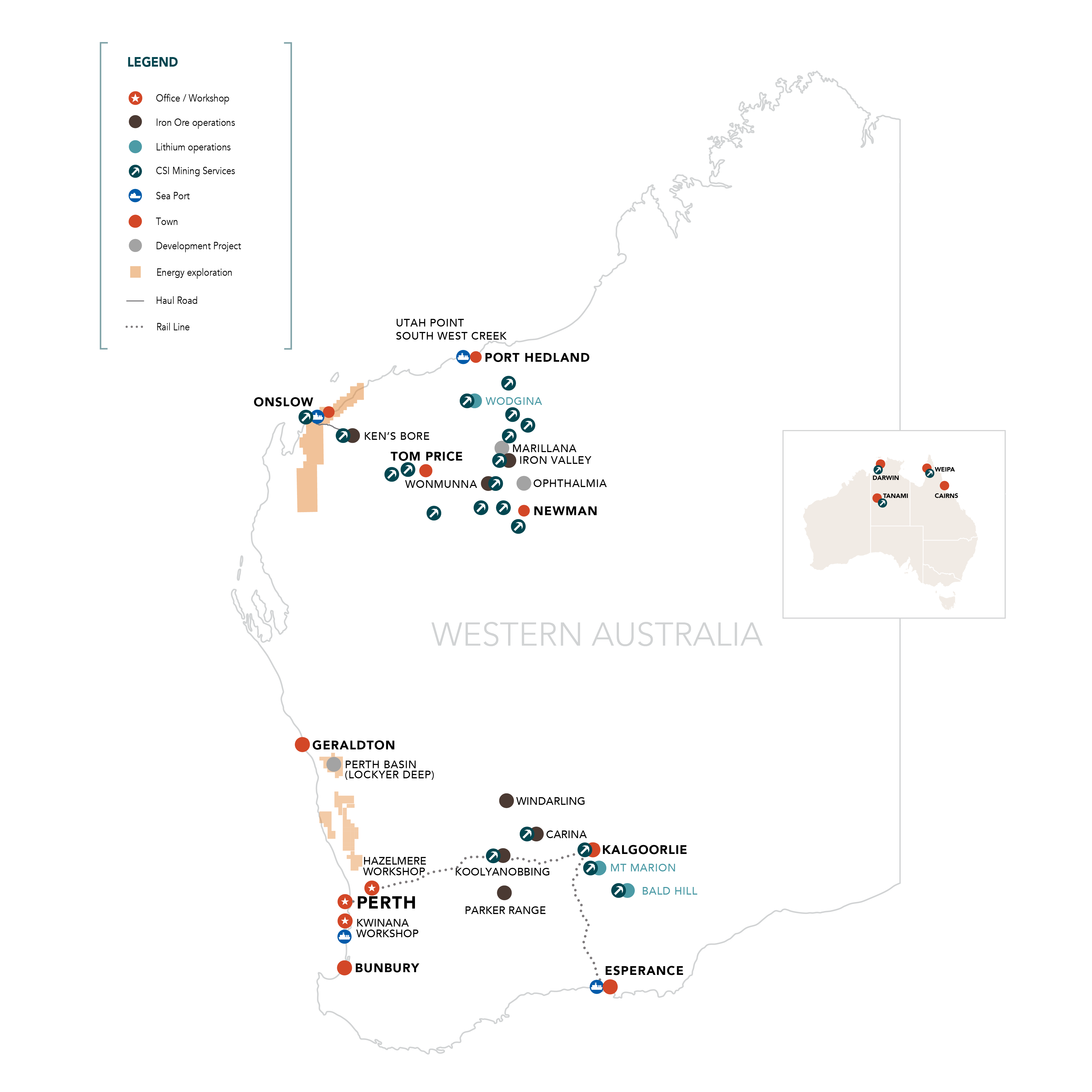

with extensive operations in .

"In FY24, Mining Services delivered an."

Our Mining Services division continues to strengthen its reputation as one of Australia’s leading providers of innovative and reliable mining services, supporting a growing list of MinRes projects and tier 1 mining clients.

Operating as wholly owned MinRes subsidiary CSI Mining Services (CSI), this key business pillar delivers pit-to-ship service capability unique to the resources industry – spanning construction, mining, crushing, processing and haulage services – specialising in build, own and operate projects.

In FY24 our Mining Services division delivered an exceptional performance, headlined by a nine per cent increase in production volumes to 269 million wmt. Record earnings of $550 million were up 14 per cent year-on-year and accounted for more than half of MinRes’ total Underlying EBITDA.

Our position as a leading mining services provider was also strengthened with six new contract awards and three contract renewals in the past 12 months.

A notable highlight was our expansion into Queensland, when in Q3 CSI was awarded a road haulage contract for Rio Tinto’s operations in Weipa. Securing this contract marked several milestones for our business, including our first project on the east coast, the first time operating at a bauxite mine site and the first time utilising multiple quad road trains.

Importantly, CSI has employed more than 50 site-based personnel to support this contract and continues to prioritise local employment and businesses to support our Queensland operations.

This year our business was also awarded crushing contracts supporting Tier 1 clients in Western Australia. These included the supply and operation of a 10Mtpa crushing plant at McPhee Creek, supply and operation of a 15Mtpa crushing plant at Hope Downs 4 and the provision of mobile crushing services at Mining Area C.

In FY24 we also deployed the latest iteration of our modular crushing plant technology – NextGen 3 – across MinRes projects and client sites. The NextGen 3 plant has been enhanced with carbon fibre screens, delivering significantly higher structural strength when compared to carbon steel. Screens were developed in-house and manufactured in less than six weeks.

"Our in-house capability continues to ."

Since its inception, MinRes’ growth has been driven by our in-house design and engineering service offering.

Through our unique operating model, MinRes has full control and flexibility of project delivery, with services consolidated under one roof. This has been pivotal in the successful delivery of infrastructure for MinRes’ flagship project – Onslow Iron.

Our in-house capability continues to drive business success and supports MinRes’ ambitious program of growth projects, with a dedicated management team focused on delivering large and complex projects.

The Engineering and Construction team is guided by metrics that set us apart from other engineering specialists, with a commitment to excellence in safety, cost efficiency and adherence to schedules.

The MinRes competitive advantage, or our "secret sauce" for achieving aggressive project schedules and capital expenditure targets, lies in our in-house control of the entire project lifecycle. This in-house capability enables us to implement a contractor-driven approach, substantially reducing timelines and providing significant schedule and cost advantages unattainable through conventional engineering, procurement and construction management.

Our service offering is unmatched. We’ve honed our expertise delivering mechanical, piping, electrical and infrastructure projects, however our capabilities extend far beyond. We pride ourselves on our technical proficiency in process design across multiple commodities, coupled with our ability to transform these designs into tangible projects.

"We are transitioning our iron ore operations to."

The past 12 months have been momentous for MinRes’ iron ore business, with the launch of our flagship Onslow Iron project.

Onslow Iron marks our company’s transition to low-cost, long-life iron ore operations that will help deliver benefits to all Australians for decades to come.

Over FY24 we experienced continued stable demand for iron ore with a preference for lower-grade products due to their price competitiveness over premium product. Iron ore prices reached a high of $143.95 in early January, before falling around 30 per cent by the end of June.

Within the Chinese market, there has been a decline in demand for steel from the property sector, however other sectors such as infrastructure, consumer goods, automotive and ship building have been growing.

With relatively good demand throughout the year for our products, we were able to draw down on inventory and ship 18.1Mtpa across our Yilgarn, Pilbara and Onslow Iron operations.

" is on lowering costs and improving efficiencies."

MinRes has spent more than a decade building a portfolio of world-class lithium assets set to deliver long-term value for the company and its shareholders.

Our portfolio includes ownership in two of the world’s largest hard rock lithium mines – Mt Marion in the Goldfields region and Wodgina in the Pilbara region of Western Australia – complemented by the newly-acquired Bald Hill mine also located in the Goldfields.

Over the past 12 months, global lithium markets experienced sustained downward pressure, influenced by global factors including oversupply of product into China, slower than expected adoption of electric vehicles and geopolitical tensions.

Despite challenging external environments, our lithium business delivered a strong operational performance including record production volumes out of Mt Marion and Wodgina. Together, these two assets shipped 419,000 dry metric tonnes (dmt) of six per cent spodumene concentrate (SC6) product and contributed to the Lithium division’s total Underlying EBITDA of $384 million.

MinRes remains committed to lithium’s long-term fundamentals and is focused on maximising the value of our three upstream operations in Western Australia. In the near term, our priority is lowering costs and reducing capital spend while maintaining flexibility to increase production when market conditions improve.

" is critical to the sustainability of our industry."

Our energy division is pursuing low-cost, reliable and cleaner fuel sources to reduce emissions and support MinRes’ future growth.

MinRes continues to actively explore opportunities for natural gas and renewable energy to provide reliable and cost-effective alternatives, reduce our company’s dependency on diesel and improve our sustainability performance.

Our Energy division will also support MinRes’ emission reduction activities through a range of hybridisation and electrification projects focused on integrating cleaner energy solutions across our operations.

MinRes has been active in conventional gas exploration since 2015 and is now the largest acreage holder in the onshore Perth and Carnarvon basins.

Sustainability Review

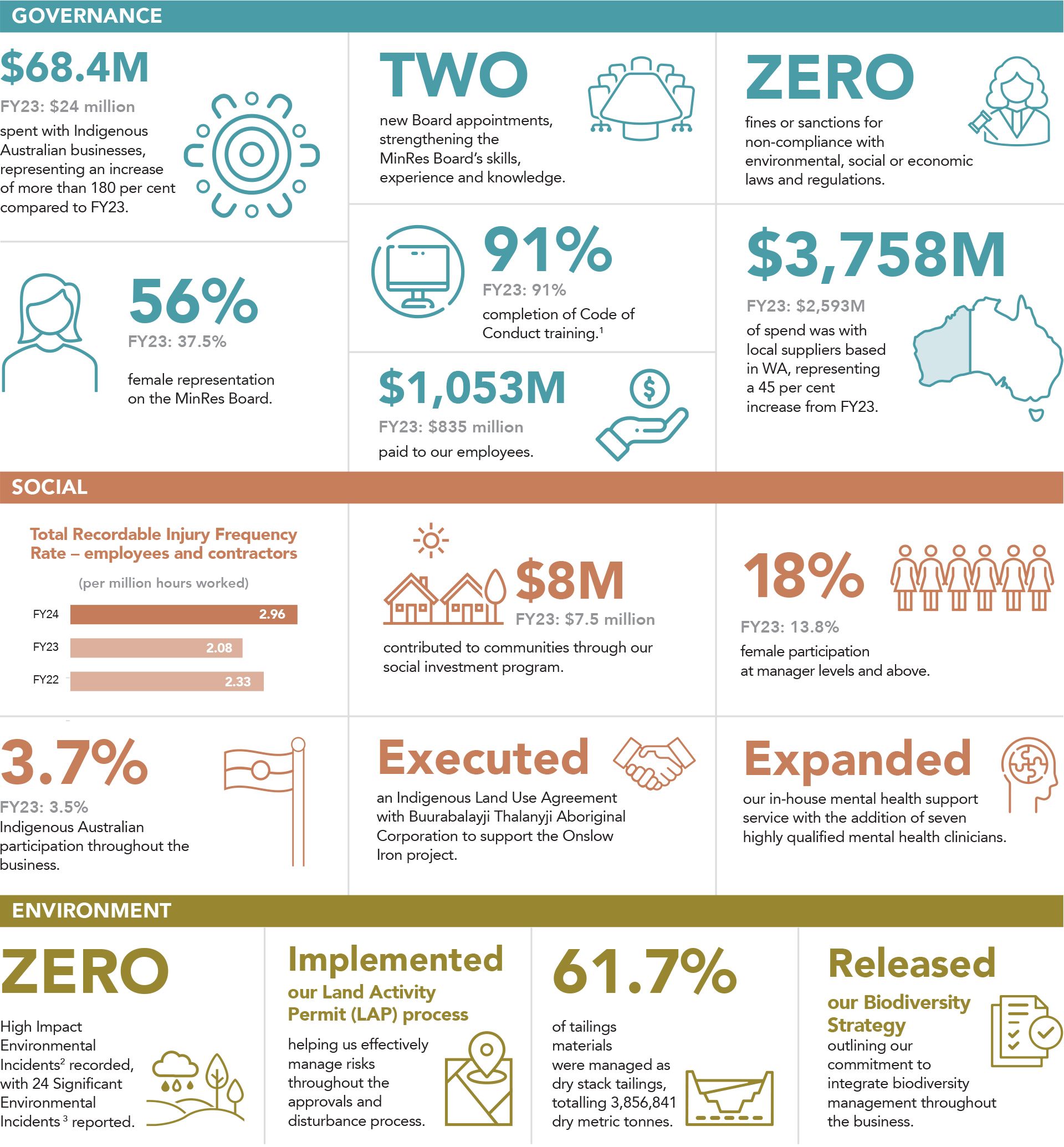

MinRes' sustainability reporting provides valuable insight into its management of material sustainability topics and performance.

Reporting covers operations wholly owned and/or operated by MinRes or owned as a joint venture operated by MinRes.

This includes functions and assets under MinRes’ influence and are reported as non-wholly owned subsidiaries within the financial statements.

Our reporting is prepared in accordance with the Global Reporting Initiative (GRI) Standards, the Sustainability Accounting Standards Board, the Ten Principles of the United Nations (UN) Global Compact, the UN Sustainable Development Goals and recommendations from the Taskforce on Climate-related Financial Disclosures.

MinRes engages independent, external assurers EY to provide limited assurance over several key sustainability performance indicators. In FY24, this included our safety performance, greenhouse gas emissions and energy consumption profile, environmental incidents, gender diversity and turnover, employee training, community contributions, supplier screening and spend, heritage incidents and the value generated and distributed. Refer to our 2024 Sustainability Report for a copy of the Independent Limited Assurance Statement.

We aim to create long-term value for our communities while producing the minerals required for our transition to a low-carbon environment, paying taxes and royalties, investing in our people and community programs, and providing returns to our shareholders.

We strive to make a difference through our leadership in mining services and operations, encouraging responsible and sustainable business practices and acting in a manner that enhances our social licence to operate. We incorporate responsible mining principles into our decision-making, long-term strategic planning and risk management processes.

MinRes’ Sustainability Policy also outlines our commitment to sustainability risk and opportunity identification, management, performance measurement and reporting. The Sustainability Policy is supported by a suite of governance policies including but not limited to an Anti-Bribery and Corruption Policy, Climate Change Policy, Human Rights Policy and a Supplier Code of Conduct.

MinRes’ Board-level Sustainability Committee strengthens our commitment and oversight of sustainability management and performance, ensuring we stay abreast of emerging trends and issues that may impact the company. In FY24 the expertise of the Sustainability Committee was strengthened with the appointment of Denise McComish, who brings comprehensive experience across financial, corporate and ESG matters in the mining, energy, financial services and infrastructure sectors.

Safety and

Diversity

Figures to 30 June 2024

18% female participation at

manager level or above

2.96 total recordable

injury frequency rate

56% female participation

on MinRes board

3.7% Indigenous

participation

- Employee completion rate excludes casual employees, interns, non-executive directors, employees on workers compensation and employees on long-term leave, including parental leave.

- MinRes classifies High Impact Environmental Incidents as incidents with an actual environmental consequence of high or major. These events have an adverse impact on flora/fauna, habitat, soil, aquatic and land ecosystems, atmosphere or water resources typically lasting multiple years (Level 4 and above).

- Significant Environmental Incidents comprise actual environmental or legal consequence of Level 3 and above.

Leadership Development

Figures to 30 June 2024

270 frontline leaders completed the Leadership Essentials program

60 inspire program participants –

more than 80% female

141% increase in female

operational leadership

Two new MinRes

board appointments

Annual Financial Report

All references to ‘Mineral Resources’, ‘MinRes’, ‘the Company’, ‘the Group’, ‘we’, ‘us’ and ‘our’ refer to Mineral Resources Limited (ABN 33 118 549 910) and the entities it controlled, unless otherwise stated.

References in this report to a ‘year’ are to the financial year ended 30 June 2024 unless otherwise stated. All dollar figures are expressed in Australian dollars (AUD) unless otherwise stated. All references to ‘Indigenous’ people are intended to include Australian Aboriginal and/or Torres Strait Islander people.

Creative Direction by Russell James OAM and Ali Franco.